The Taiwanese Retail Investment Market

Abstract

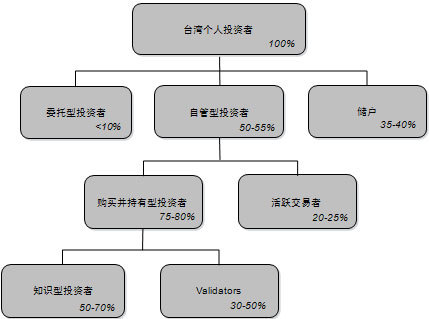

Taiwan's retail investors are among the most active in the world. An estimated 15% of Taiwan's 6.5 million retail investment accounts, or 975,000 accounts, belong to active traders.

In a new report, , Celent analyses the characteristics of Taiwan's retail securities market. The report provides a classification of retail traders, financial products and the market, and the competitive landscape. It looks at contributions by investors in different categories based on capital allocation, educational background, age and geographic location, and other characteristics.

Compared to the mature markets of Hong Kong, Taiwan’s GDP is lower, reflecting the fact that it is still developing. The banking industry is more fragmented, leading to increased competition. In terms of foreign investors, Taiwan’s financial markets are nearly as open as markets in the surrounding areas.

"Although participation by institutional and foreign investors is growing, domestic retail investors still dominate Taiwan’s investment market," says Hua Zhang, Celent analyst and author of the report. "While the retail futures market is significant, equities are the investment product most favored by Taiwan’s individual investors."

This report presents a competitive analysis of Taiwan's retail brokerage industry. Market leaders discussed in the report include YuanTa Securities, Polaris Securities, SinoPac Securities, Central Trust of China, and Jih Sun Securities, with detailed tables presenting these brokerages’ features and marketing strategies.

The report also presents an overview of Taiwan's futures and options brokers as well as online brokerages. It compares Taiwan's financial market to the markets in its surrounding areas. Additionally, it covers the following markets in Taiwan: foreign exchange, bonds and securities, futures, and options.

The 34-page report contains three tables and 25 figures. A table of contents is available online.

Members of Celent's Wealth Management research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.