Strategic Expense Management for Investment and Corporate Banking Executives

Abstract

Strategic Expense Management for Investment and Corporate Banking Executives

In the past, corporate and investment banking businesses experienced strong, long-term growth. Despite market crises over the past twenty years, revenues have seldom fallen for more than a year, and the industry has always been able to grow back to profitability. The current crisis, however, is different, making cost cutting and restructuring necessary.

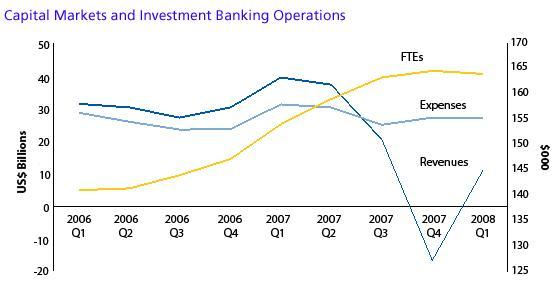

In a new report, Strategic expense management for investment and corporate banking executives, research by Celent and Oliver Wyman finds that a great deal of risk comes from the fact that, as revenues tumbled in the fourth quarter of 2007, costs continued to grow. Many financial institutions have hesitated to cut costs or reduce headcounts in the hopes that revenues would rebound quickly and painful cost cutting measures could be avoided.

Unfortunately, it is unlikely that there will be significant improvement in the market in 2009. Historically, cost cutting programs have helped contain, but not compensate for declines in revenues. Celent believes the reason for this is that cost cuts implemented are short-term and tactical, rather than structural.

This report begins with a review of the business case. With the investment banking industry in flux, the time to change inefficient processes and optimize organizational structure with an eye to cost management is ideal. It then identifies how leading institutions are reacting to such an unfavorable business scenario by adopting initiatives that aim at streamlining the organization and focusing on the strategic management of costs. The report continues with an overview of the current state of expense management activity.

By suggesting a possible end state, the report identifies areas of improvement, including:

- Product strategy

- Organizational structure

- Compensation

- Rationalization and engineering of front, middle, and back office operations

- Cost management

- Regulations

- M&A

Finally, the report examines a number of case studies that suggest improvements in the areas of: organizational design, customer segmentation, and changes in the regulatory environment.

"Market dynamics demand stable profit growth. Expense management must be paralleled with revenue growth and new business generation," says Enrico Camerinelli, senior analyst with Celent’s banking group and author of the report. "Celent expects that the next five years will see financial institutions that want to prevail in the market planning initiatives which encompass areas under their direct control, as well as domains that require the ability to anticipate and manage external forces."

The report is 24 pages long and contains four figures. A table of contents is available online.

of Celent's Corporate Banking research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.