Start Coding Investment Research: How to Implement MiFID II with Robots and AI

Abstract

Celent has released a new report titled Start Coding Investment Research: How to Implement MiFID II with Robots and AI. The report was written by Joséphine de Chazournes, a Senior Analyst in Celent’s Securities & Investments practice.

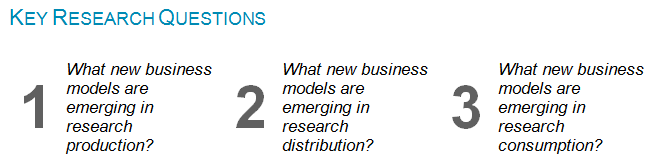

Technological breakthroughs in narrow artificial intelligence (AI), developments in robotic process automation (RPA), and the advent of the cloud are enabling groundbreaking changes of investment research business models.

A wide range of business models are emerging, from standard automatically produced RPA+NLG notes to high end personalized insight enhanced by RPA and AI analysis.

A myriad of distribution niches will be available to respond to various client needs: lower costs, independence, higher quality, etc. thanks to RPA and AI technology, but also to cloud.

Digesting data and insight, selecting the good value for money, data, and insight, monitoring the compliance of consumption, and being able to pay for data in a compliant way are the focus of the new consumption models.

“The disruptive models will adapt to the new sharing, distributed, and disintermediated economy by providing not only production but also client interaction in the cloud, and putting the client in the driver’s seat,” de Chazournes said.

“Research providers will differentiate the cost and quality of the end product by choosing the mix of human and machine interaction that is most suited to their clients’ needs,” she added.