SEPA: Banks Are Building It, But Will Corporate Customers Come?

Abstract

?

The Single Euro Payments Area (SEPA) initiative is already live and could have a significant impact on European business. However, complaints, concerns, and finger-pointing among regulators, banks, and corporations currently prevail over progress.

In a new report, ?, Celent examines how banks, regulators, technology vendors, and corporations are approaching the SEPA initiative, launched as the implementation project of the European Union's Lisbon agenda. There is a general consensus that collaboration and cooperation will help overcome initial strife, but none of the constituents seems willing to take the first step. This report focuses on each constituent's business focus and targets, identifying gaps and areas of convergence.

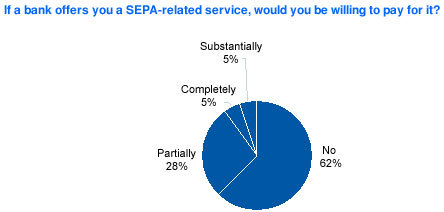

The report begins with an examination of corporate awareness about the SEPA initiative. This is supported by results from a recent survey across European operations managers, purchasing directors, supply chain executives, treasurers, and finance directors. It then examines the role played by banks and their initiatives to promote SEPA to their customers. The report continues with some consideration of SEPA's impact on corporate supply chains, incorporating an overview of the solutions and strategies adopted by IT vendors in approaching the payments market within the new SEPA environment. Finally, the report scrutinizes the role of regulators and predicts the next steps for key stakeholders.

"Industry forces have pushed organizations to focus primarily on costs and quality under the current climate of clear economic stress," says Enrico Camerinelli, senior analyst with Celent's banking group and author of the report. "Celent has identified the key criteria that corporate executives should adopt in order to link financial objectives with SEPA's expectations."

The following vendors and banks are included: SAP, Clear2Pay, and Deutsche Bank.

The report is 68 pages long and contains one table and 18 figures. A table of contents is available online.

Members of Celent's Wholesale Banking research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.