Securities Settlement Revolution: The Advent of a New Repo Market and JGB T+1 Settlement

Abstract

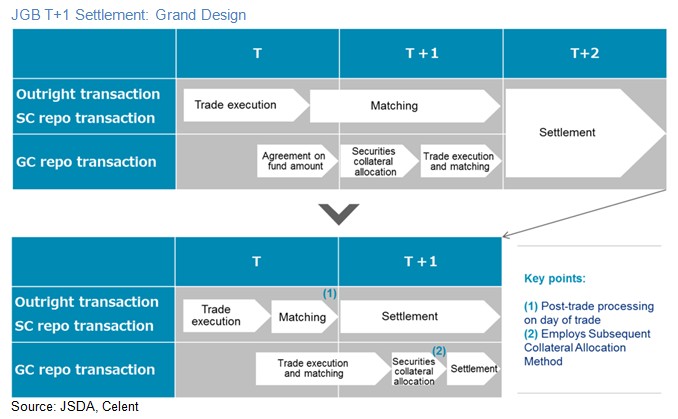

This report examines the efforts planned and in progress to shorten the settlement cycle of Japanese government bonds (JGBs) from two business days after the trade date (T+2) to one (T+1).

Celent has released a new report titled Securities Settlement Revolution: JGB T+1 & the Dawn of a New Repo Market. The report was written by Eiichiro Yanagawa, a Senior Analyst with Celent’s Asian Financial Services practice.

This report examines the efforts planned and in progress to shorten the settlement cycle of Japanese government bonds (JGBs) from two business days after the trade date (T+2) to one (T+1). This series of reports on the so-called “securities settlement revolution,” will focus on key trends and changes in the securities settlement market of Japan while exploring legacy systems and ecosystem migration as well as the related possibilities of innovation and emerging technologies in this context.

Market participants should take this event as an opportunity to modernize their business processes and systems:

- Initiatives to shorten the settlement cycle for JGBs and securities.

- Efforts to enhance the functions, and expand the use, linkages, and integration of the CCP.

- Enhanced functions of the central securities depository (CSD).

- Accelerated adoption and use of straight-through processing by market participants.

- Facilitating smoother cross-border securities settlement. The revolution in the works will go beyond mere cosmetic reforms to the market system.

This new market, envisioned to reach a scale of 20 trillion to 30 trillion yen, could cause structural change.

- The coming watershed in repo trading is an opportunity to create a new repo market.

This is because of the shift from Japan’s unique “gentan” repo (securities-lending

approach) to the “gensaki” approach, which is the international norm. - With the advent of this new system, a same-day settlement market will emerge in

Japan’s money market.

“Technology continues to evolve. It advances without waiting for the financial industry or its players to come to grips with it or to develop pertinent applications. The securities settlement revolution in Japan has unfolded slowly, requiring more than 15 years all told. The coming financial infrastructure revolution should not take place at such a glacial pace,” commented Yanagawa.

“Financial institutions find themselves at a point where they should reconsider their approaches to financial infrastructure management. System reform will need to be tackled. Loosely coupling (or unbundling) connections with the financial infrastructure (exchanges, clearing houses, and settlement infrastructure) can increase the available options in business and IT sourcing models, contributing to strategic flexibility," he added.