Robo UMA: Automated Advice and the Battle for the Affluent Investor

Abstract

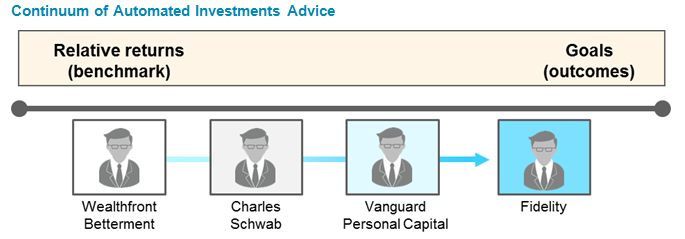

Today, the line between robo advice and managed account technology is blurring.

Celent has released a new report titled Robo UMA: Automated Advice and the Battle for the Affluent Investor. The report was written by William Trout, a Senior Analyst with Celent’s Wealth Management practice.

A shared focus on tax management represents a starting point for greater integration and the construction of a digital platform that is fully relevant to the investor The diffusion of discrete operational tech (centering on portfolio risk; rebalancing; and trading/accounting functions) through a digital lens that has the potential to disrupt the turnkey asset management provide (TAMP) business model. Account performance is directly influenced by the quality of the rebalancing process, and reflected in terms of dispersion, tax savings/losses, and the management of cash positions.

“Since the 2000s, the development of the UMA has been iterative, not innovation driven. TAMPs have solidified their market position, but at a long-term competitive cost," commented Trout.

“TAMPs like Vestmark, FolioDynamix, and Envestnet face a strategic reckoning. Partnerships and acquisitions are on the table as digital disruptors capture the zeitgeist, and increasingly, market share,” he added.