Market Updates and Investment Trends--Where the Money Is Going

Abstract

Market Updates and Investment Trends: Where the Money Is Going

Given current market upheavals, which core themes do investors concern themselves with? And what investment stance will they take on different assets when normalcy returns to the markets? In short: Where is the money going?

The credit crisis adversely impacted large parts of the capital markets. In a new report, Market Updates and Investment Trends: Where the Money Is Going, Celent examines how the main asset classes and investor pools have responded to the unfolding crisis and what the future holds for them.

Key report findings include:

- All assets "remain on the table" despite the credit crisis, but demand for new complex structured products will be limited.

- The bond market will struggle to shake the credit crisis. Yet discriminating investors can still find value in strong corporate bonds. Although the crisis does not spell the end of the structured credit and securitization market, the shape of these markets is likely to change when they return: they will come back at a smaller, but still significant size, and use simpler structures.

- Notwithstanding the recent pullback in commodities, the forces that led to the recent bull cycle look set to continue: The macro trend of rising demand, supply side constraints, and the entrance of institutional investors, will make the fundamentals of commodities stronger in the long run.

- Despite the current bleak picture, our long-term outlook for emerging markets is bullish. The underlying story is the growing purchasing power of rapidly expanding middle classes, notably in China and India. However, the credit crisis has shown that investors must be wary of the "decoupling" sales pitch, because both the developed world and commodities remain strong influencers.

- OTC markets are likely to take a back seat to listed derivatives, but we believe that both markets will coexist in the long term, because they cater to different needs. Due to heightened regulatory pressure, however, the migration of some OTC market activity to central clearinghouses and ultimately to official exchange platforms will gain momentum.

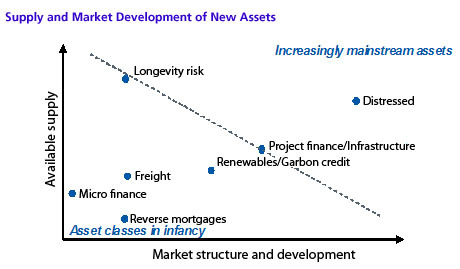

- Demand for new assets is strong, driven by the search for value and uncorrelated returns. Yet, new assets must be viewed individually because the term encompasses markets at vastly different stages of the development cycle in terms of their currently available supply and market development.

"Liquidity and risk premium were significantly undervalued leading up to the crisis,’" says Isabel Schauerte, an analyst with Celent’s Securities & Investments Group and co-author of the report.

"Liquidity has been taken for granted. That can’t be the case any longer. Investors will demand an appropriate premium for illiquidity going forward," she adds.

The 78-page report contains 44 figures and four tables. A table of contents is available online.

of Celent's Capital Markets research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.