Leveraging Consumer Data and Smart Technologies in Insurance: Mind the Gap!

Abstract

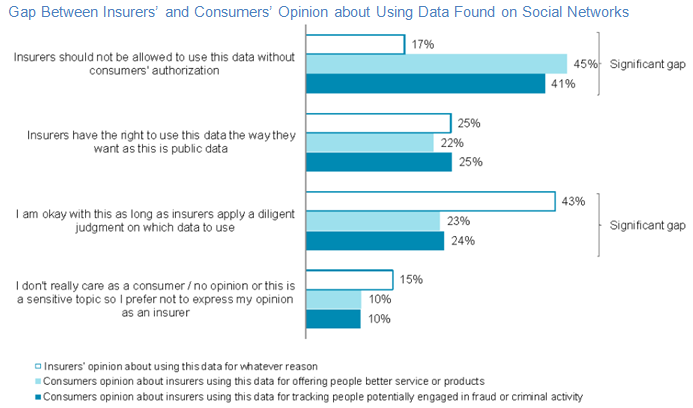

There is a gap between what insurers think and what consumers think about the use of private data found on social networks.

Celent has released a new report titled Leveraging Consumer Data and Smart Technologies in Insurance: Mind the Gap! The report was written by Nicolas Michellod, a Senior Analyst with Celent’s Insurance practice.

Today, insurance companies have access to a plethora of data, and they need to carefully assess how to capture consumer data and where to find the sources.

Insurers are well aware that customers prioritize the speed to get relevant information and also the intuitiveness of tools and interfaces. There is a gap between what insurers think and what consumers think about the use of private data found on social networks. While almost half of consumers think insurers should not be allowed to use this data without their authorization, this proportion is less than 20% on the insurance side.

Only a minority of insurers have already invested in these technologies, and machine learning has the best traction. However, a high proportion of insurers are going to invest or are thinking whether it makes sense to invest in smart technologies, with artificial intelligence being the preferred technology.

“Insurers need to challenge their current business model in the light of data they can now leverage as well as the technologies available to turn this data into valuable information,” commented Michellod.

“With the importance taken by external data sources and the technologies that can leverage them, insurers need to adapt to make the most of these changes,” he added.