Legacy Modernization in the Japanese Securities Industry, Part 2: Prescriptions and Proposals

Abstract

Legacy modernization in the securities industry is much more than the application of novel technology. Rather, it portends nothing less than a structural overhaul. It is an opportunity to envisage anew and redefine the industry’s future. There can be no doubt that this transcends the establishment of a digital channel; rather it will certainly impact products, services, IT units, and sourcing models, and, in so doing, provide the securities service providers of the future a chance to seriously consider exactly what kind of companies they would like to be and the corporate cultures they would like to foster.

Celent has released a new report titled Legacy Modernization in the Japanese Securities Industry Part 2. The report was written by Eiichiro Yanagawa, a Senior Analyst with Celent's Asian Financial Services practice.

This report is based on a legacy modernization survey Celent conducted in 2015. The survey targeted securities firms, financial institutions, and brokers. It was supplemented with information gathered in follow-up interviews. The previous report spanned the financial industry, reporting on Celent survey results, putting forth an analysis of the results and salient comments from interviews, and examined the overall implications of legacy modernization trends across the industry.

This new two-part report is an extension of this work that narrows the focus to the securities sector. Part 1 offers an overview of the state of modernization in the industry. Part 2 builds on this to offer policy prescriptions and suggestions for industry players. The reports also provide an overview of the industry systems in Japan and the future vision.

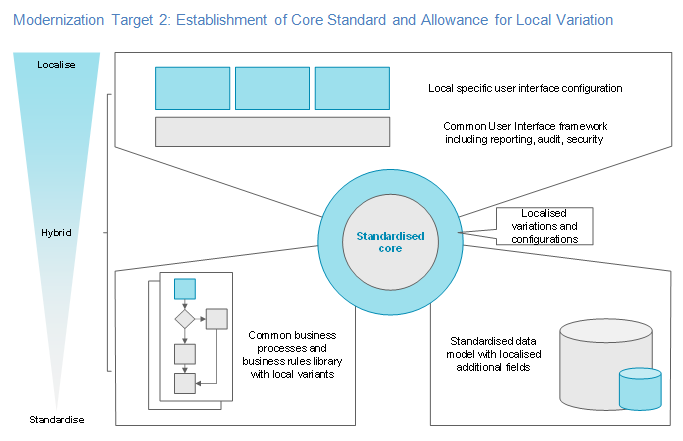

More securities firms are seriously considering legacy modernization and moving to the implementation stage: The norm for replacement strategies is increasingly the deployment of a new system rather than a version upgrade or wrapping, with the decision driven by cost, fit with existing IT skill and aptitude levels, and risk tolerance. Securities firm legacy system modernization means migrating a securities firm’s core system, including business operation functions, integration, support, new product development, scalability, and sourcing models, to a more modern configuration to streamline operations and create business opportunities.

Business drivers of system modernization are typically a desire to implement a growth strategy, restructure and rebuild business units, and realize new processes (high-efficiency STP) to respond to changes (more digitization) in demand.

- Understand the legacy modernization framework.

- Understand your organization’s priority challenges and risk tolerance.

- Define the scope.

- Ensure that the modernization does not simply reproduce legacy issues.

“In the securities services value chain there exist both areas where firms can and should go it alone to generate unique in-house high value-added services and products, and others where they stand to benefit by collaborating with other firms to drive down costs. Also, if firms thoroughly consider economies of scale and economies of scope, they can collaborate with other firms, parlay their cost centers into new profit centers and play a role in the industry infrastructure,” says Yanagawa.

“In actual operation, after deliberating and implementing such initiatives, big data analytics and automation of all processes will prove key. Here as well, a shift to a modular supply structure will be required, and a critical factor in determining the success of financial institution management will be alliances — namely how adroitly firms partner with other entities,” he adds.