Legacy Modernization in the Japanese Securities Industry, Part 1: Survey Analysis and Status Update

Abstract

Japan’s securities industry finds itself in a fairly unique situation in terms of modernization, one which most companies might liken to a ship leaving port on a voyage without navigational charts to guide them. Unfortunately, the results of the Japan securities firm survey only serve to reinforce this assessment.

There is little belief that legacy modernization — that is to say, the modernization of core systems — can lead to a more robust industry. Rather, securities firms fear altering existing processes designed to engender innovation in past products and services and also the costs and risks of “disruptive changes” to department units and their functions.

It is largely understood that modernization of core systems encourages a shift to straight-through business processes, automation, and self-service, yet awareness is low that the digital behavior of customers encourages modernization. Within companies there is a visible lack of “entrepreneurs” and initiatives that try to go beyond the conventional missions and purviews of systems units and business units to lead modernization projects.

Celent has released a new report titled Legacy Modernization in the Japanese Securities Industry Part 1. The report was written by Eiichiro Yanagawa, a Senior Analyst with Celent's Asian Financial Services practice.

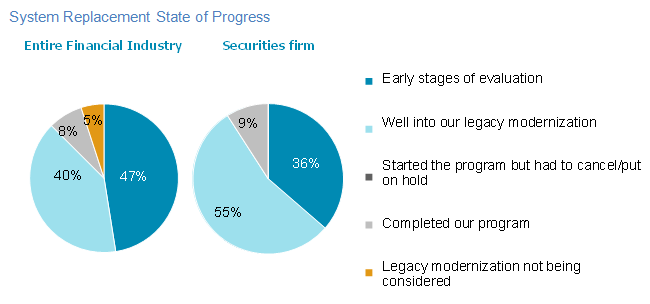

This report examines the current status and future directions of legacy modernization in Japan’s securities industry. It is based on a legacy modernization survey Celent conducted in 2015. That survey targeted securities firms, financial institutions, and brokers. It was supplemented with additional information gathered in follow-up interviews. The previous report spanned the financial industry, reporting on Celent survey results, putting forth an analysis of the results and comments from interviews, and examined the overall implications of legacy modernization trends across the industry.

This report is an extension of this work that narrows the focus to the securities sector. Part 1 offers an overview of the state of modernization in the industry. Part 2 builds on this to offer policy prescriptions and suggestions for industry players.

More and more securities firms are seriously considering legacy modernization and moving to the implementation stage. The norm for replacement strategies is increasingly becoming deploying a new system rather than a version upgrade or wrapping, with the decision driven by cost, fit with existing IT skill and aptitude levels, and risk tolerance. As organizations progress to the implementation stage of replacement projects, SaaS and BPO solution deployment was most aggressive in the securities industry compared with banks and insurers. Business cases could be used better. They are generally only used as tools to monitor progress, rather than functioning as live documents.

“Core systems in the securities industry are a conglomeration of multiple subsystems that are connected to form a dynamic value chain. And they have actively evolved in accordance to changes in economic environment and market structure by modifying key components such as when it comes to products, trading, settlement, and risk management, as well as in fluctuations in the economic value of these,” says Yanagawa.

“These core systems have been crafted and cobbled together over an extended period of time in such a way and intimately linked in complex ways both internally and externally. After considering system modernization options, it is highly likely that firms will end up with a piecemeal solution that is narrow in scope, such as one focused on individual securities firms or asset management firms in one very small corner of a vast value chain,” he adds.