Integrated Payables: Raising the Bar on Customer Experience

The time is ripe to invest in integrated payables with demand and supply aligning.

Abstract

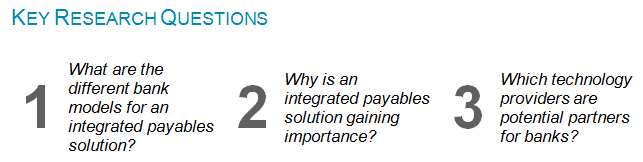

Celent has released a new report titled Integrated Payables: Raising the Bar on Customer Experience. The report was written by Alenka Grealish, a Senior Analyst with Celent’s Banking practice.

With demand and supply aligning, the time is ripe to invest in integrated payables. Given banks’ increasing drive to differentiate, Celent expects the adoption of integrated payables to increase from around 3% of total B2B addressable payments value in 2016 to nearly 6% by 2020.

“Supply,” the ability to deliver reliable, results-driven (i.e., migration from check to e-payments and material cost savings) solutions to small and mid-market companies has been proven. “Demand” from companies has been not only unmet, but also is now increasing, driven by rising fraud exposure and cybersecurity risks, increasing payments complexity, and pressure to operate more efficiently.

A successful partner selection process is part art and part science. The art is in judging how collaborative and flexible the partner is in areas such as integration with the bank and revenue sharing. The science is being as data-driven as possible.

“For banks, the strategic key to success is shifting from selling product to embedding their services in the financial workflow of their customers. An integrated payables offering can be their catalyst,” commented Grealish.

We profile eight providers in this report: AvidXchange, Bill.com, Bottomline Technologies, FIS, Fiserv, MineralTree, Nvoicepay, and Viewpost.