Insurtech in Asia: Changing the Rules of the Game

Insurtech companies are challenging incumbent insurers all across Asia.

Abstract

NEW YORK -- Celent has released a new report titled Insurtech in Asia: Changing the Rules of the Game. The report was written by Wenli Yuan, a Senior Analyst with Celent’s Asian Financial Services practice.

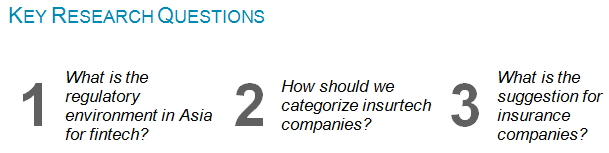

Fintech startups are changing the nature of the financial industry. Insurtech companies are challenging incumbent insurers all across Asia, in Singapore, China, Hong Kong, India, Malaysia, Thailand, the Philippines, and Indonesia.

Many countries have established regulatory “sandboxes,” relaxing some regulations to allow fintech firms to experiment with new business models and products. Insurtechs are disrupting the insurance industry in areas including customer acquisition and communications, products, claims management, and data intelligence, as well as creating new ecosystems. This report profiles over 30 noteworthy startups in the region.

“Consumers want interesting and consumer-centric products, and as of yet traditional insurers have not delivered,” commented Yuan.

“Celent suggests that insurers view insurtech as an opportunity rather than a threat, explore the possibility of new partner models, and follow the market for insight and idea creation,” she added.