Insurance Data Mastery Strategies

Abstract

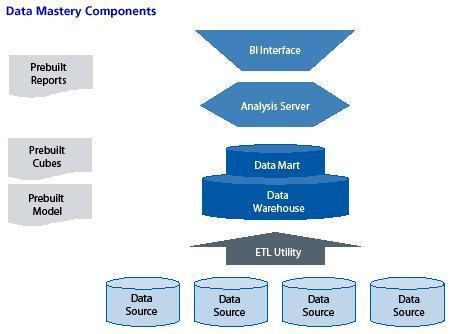

With the current economic crisis a focus of all insurance planning, data mastery remains a top priority. Being able to get better intelligence from corporate data will be crucial to reducing costs, determining areas for automation, and helping to survive in an environment where regulation is more important than ever.

In a new report, , Celent provides an overview of the structures, technologies, and uses of data mastery within the insurance industry, as well as some best practices and guidelines. While the focus of data mastery investment may change to reflect an altered market, the percentage of IT budget spent on data mastery projects is expected to stay the same, if not increase

"In a time when insurers will be carefully watching every IT dollar, investment in data mastery solutions will stand out as an opportunity for both short-term gains and long-term strategy," says Jeff Goldberg, senior analyst with Celent’s insurance group and author of the report. "Good data mastery will help a company find areas for increased efficiency and cost reductions."

This report is published along with a companion report, Insurance Data Mastery Solution Spectrum. Dozens of vendors offering solutions related to data mastery are reviewed in the companion report. The 32-page report contains 10 figures and 3 tables. A table of contents is available online.

of Celent's Life/Health Insurance and Property/Casualty Insurance research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.