Enterprise Payment Management: Banks Must Follow an Enterprise Approach to Payments to Compete and Lead

Abstract

The catalysts for moving toward an enterprise approach to payments management and the industry's response to these catalysts will reshape the US banking industry. There will be a transformation in how payments are processed and distributed, how operations and organizations are managed, and the roles of providers.

Having survived the retail movement of deposits to the stock market, explosive mergers and acquisitions, Y2K, and the Internet bubble, payment operations seem invincible. The fact is that these systems were not designed for the rate of change they have seen, but have survived because of difficult decisions, brute force, and extreme effort. These aging systems and overly complex operations are not set to support banks' needs in the future.

It is imperative that banks reevaluate their payments strategy from an enterprise perspective and thoughtfully assess their ability to execute in order to maximize stakeholder value into the future. Although a great deal of effort has been put into the enterprise concept, the US is only at the beginning of what will be a great evolution in the banking and business community. A new report, , provides insights to motivate US bank executives to assess their existing payments strategy and operational capacity to seek opportunities before the market limits their options.

These insights are segmented into five areas.

- Banks most susceptible to changes in the payments market

- Trends shaping the future payments marketplace

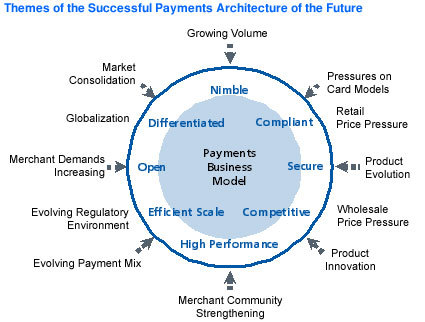

- Mega-themes supported by the next generation of payments franchises

- The role of enterprise payment management

- Preparing the payments organization for change

"The wise bank needs to reevaluate its operation. 'Don't fix it if it ain't broke' is a tempting argument until the bank realizes that a system incapable of supporting its future needs is 'broke' and, without the proper investment, could ultimately break the bank," says Edward Woods, senior analyst with Celent's banking group and author of the report.

The payments market is changing, and banks must have a plan that maximizes future potential. Having an enterprise plan for the payment franchise is an opportunity that no bank should miss. "It's a new world. The bank must change to survive and innovate to thrive. With an efficient, focused payment operation ready and able to respond to its needs, the bank will be in its best position to navigate the waters of both today and tomorrow," he adds.

This 44-page report contains 9 figures and 11 tables. A table of contents is available online.

Members of Celent's Retail Banking and Wholesale Banking research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.