Emerging Technologies for Core Systems: 2017 Edition

The definition of a modern insurance system is changing, and so is the business case.

Abstract

Celent has released a new report titled Emerging Technologies for Core Systems: 2017 Edition. The report was written by Craig Beattie, a Senior Analyst with Celent’s Insurance practice.

The definition of modern insurance systems is changing, and so is the business case for them. In this report Celent examines the trends driving the change and how the insurance industry will benefit in the future.

Celent’s landmark 2008 report, The Business Case for Modern Policy Administration Systems, described the benefits of upgrading legacy systems. The benefits covered in the 2008 report still stand, but this report presents new sources of benefits and makes the case for a new modern system.

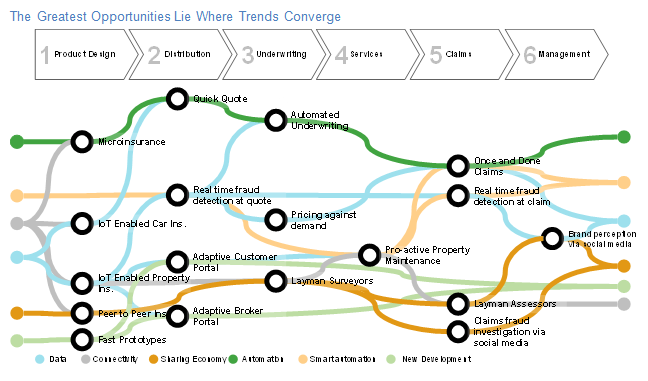

Seven trends are impacting insurance: connectivity, crowd, data and analytics, automation, smart automation, new development, and changes in the ecosystem.

The greatest source of opportunities is where the trends converge. These intersections are enabling new solutions to old problems and, in some cases, new business models. Three examples would be products enabled for the Internet of Things, adaptive portals, and crowdsourced staff. Newer systems are capable of interacting with these trends and better able to capitalize on them.

“We are at the start of a new phase in insurance core systems similar to the adoption of Java Enterprise Edition and .NET frameworks over a decade ago,” Beattie said. “This time, however, the dominant design has not yet been established and isn’t owned by one or a few parties.”