DenizBank: Fast Loan for SMEs

Abstract

Celent Model Bank Award: DenizBank: Fast Loan for SMEs

Winner of Celent Model Bank 2017 award for Lending Products. To facilitate SME access to financing and render the associated paperwork process more efficient, DenizBank launched Fast Loans for SMEs.

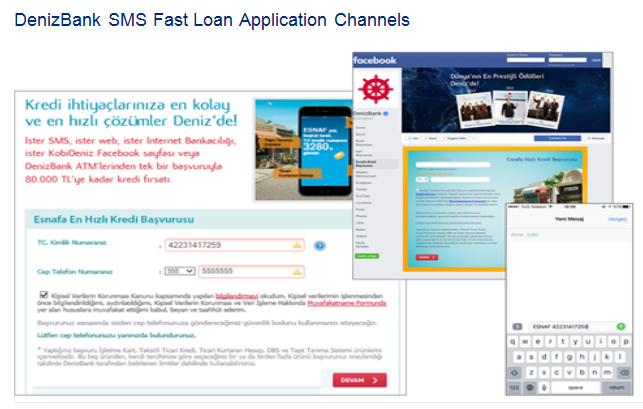

DenizBank's Fast Loan for SMEs solution generates two-minute umbrella credit decisions for applications submitted through five channels (internet banking, ATMs, bank website, SMS, and Facebook) for five products (credit card, installment loan, overdraft account, direct debit, and vehicle fueling ID).

This year’s submissions for the Celent Model Bank 2017 award for Lending Product focused on improving the speed and convenience of loans for micro and small businesses. Initiatives included expanding both digital and physical application channels, along with faster loan decisions enabled by advanced analytics and paperless (or almost paperless) loan closings.

To accomplish fast credit decisions, DenizBank created an artificial intelligence framework which could analyze application data in a "blink" speed and deliver critical information to operational teams quickly and efficiently. Before Fast Loan, it took the bank 4-5 days on average to process a SME credit application. Fast Loan shortens this process to 2 minutes for approval, with the customer able to withdraw funds immediately from the nearest branch on a business day for non-customers, and 24x7 from an ATM for DenizBank customers.

DenizBank's Fast Loan for SMEs Model Bank entry stands out as it offers five channels for a small business to apply for an umbrella credit line for five different products. Application channels span internet banking, ATMs, bank website, SMS, and Facebook. The umbrella credit line covers credit cards, installment loans, overdraft accounts, direct debits, and vehicle fueling ID.

"DenizBank’s Fast Loan for SMEs Model Bank entry stands out as it offers five channels for a small business to apply for an umbrella credit line for five different products," commented Patricia Hines, Senior Analyst in Celent's Banking practice.

"With the ability to apply through text message and Facebook, along with an umbrella credit limit for five products in less than two minutes, Fast Loan is the first of its kind in the Turkish SME banking market," she added.