Clearing the Bar: Digitizing New Business with Technology and Tools

Abstract

Most life insurers have room to improve their new business processes and cost structures without compromising their ability to accurately underwrite risk. Although a variety of systems exist to automate the new business and underwriting process, the majority of insurers are not using them; paper applications and manual underwriting still reign supreme.

Celent has released a new report titled Clearing the Bar: Digitizing New Business with Technology and Tools. The report was written by Karen Monks, an Analyst with Celent’s Insurance practice.

This is the second report using data from a 2016 New Business Benchmarking Survey. The first report compared data based on the average face value of products sold by the participating insurers. This report presents the same benchmarking data but considers technology as the main focus. It compares the overall averages for a set of key metrics with the averages for high and low technology users throughout the new business process. Comparisons to Celent’s 2007 report, Raising the Bar: Tools and Tactics to Drive Life New Business Efficiency, will also be made.

Electronic applications, imaging, workflow, automated ordering and receipt of underwriting evidence, and e-signatures are used by at least one half of the insurers in the study.

For insurers that implemented technology throughout their new business process, metrics are lower for NIGO, cycle time, and unit costs.

The budget per application for insurers with a full suite of technology is US$237 and budget per policy issued is US$329, compared with $314 and $53, respectively for those without.

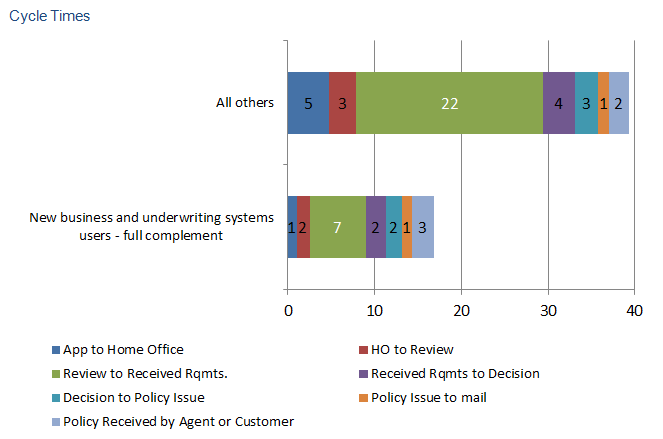

For those that implemented e-apps, the weighted average NIGO is 5%, whereas the weighted average for paper applications is 14 times higher at 69%. The average cycle time for insurers with the suite of technology is 17 days; in contrast, insurers with less or no technology have an average cycle time of 39 days.

Automation speeds up cycle time, improves accuracy, and reduces costs. It can divert people to higher value work or reduce staffing levels, depending on the strategy being pursued.

“Few insurers have maximized the potential value of new business automation, but the findings in this report show the time savings and cost reduction potential of implementing technology across the new business process flow,” Monks said.

“For insurers that understand their own costs, getting comparative data on an industry level is a great step in understanding where one stands in the market. While it may be difficult to generate accurate points of comparison across insurers due to differences in customer types, lines of business, and distribution channels, all of which strongly impact unit costs, comparisons at a high level still make sense,” she added.