Buy Side Cross-Asset Trading Technology: Putting the Pieces Together

Abstract

The buy side is remapping their trading desks in order to leverage the growing similarities in market structure across equities, options, derivatives, fixed income, and FX.

Celent has released a new report titled Buy Side Cross-Asset Trading Technology: Putting the Pieces Together. The report was written by Brad Bailey, a Research Director with Celent’s Securities & Investments practice.

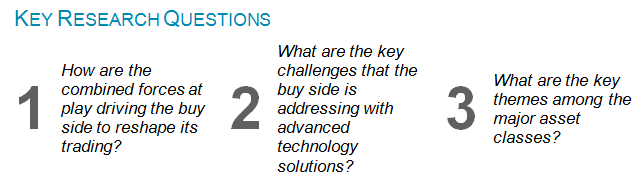

In this report, Celent looks at the forces driving the buy side to “desilo” trading desks to maximize effectiveness across asset classes. The buy side is remapping their trading desks in order to leverage the growing similarities in market structure across equities, options, derivatives, fixed income, and foreign exchange.

Increasing assets, massive volatility, converging market structures, and a complicated regulatory environment, all combined with a remapping of engagement with their sell side partners, are driving buy side firms to become more self-sufficient in their trading and executions across asset classes.

The key challenge for most buy side firms is building trading and execution desks that can leverage both technology and expertise across asset classes to maximize the products they can effectively trade. They are looking to create powerful analytic tools, trading cost analysis, and other methods to determine best execution as well as true trading costs. There is demand for technology solutions that can be leveraged across asset classes but still offer nuanced ability in a given asset class.

The buy side is taking many lessons from the process that evolved in the electronification of equities, and bringing those lessons to other asset classes to create unified workflows that maximize automation and minimize redundancy.

“The buy side is looking to automate the easy flow in equities, ETFs, options, futures, FX, and fixed income so they can focus on the challenging trades that require human guidance and expertise,” commented Bailey.

“Changes in technology, market structure, and regulation are occurring so fast that firms need robust solutions to engage multiple types of liquidity as well as strong middle and back office functionality. Most firms want the best-of-breed technology for their liquidity sourcing and execution, but they also want one back office,” he added.