BMO: Digital Transformation in Personal Banking Winner of Celent Model Bank 2017

Abstract

Celent Model Bank Award: BMO: Digital Transformation in Personal Banking Winner of Celent Model Bank 2017

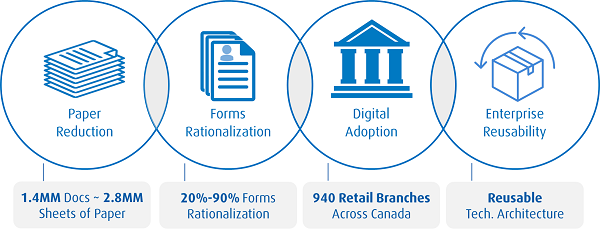

Winner of Celent Model Bank 2017 Award for Process Management. BMO has implemented an enterprisewide eForms and eSignature shared services platform in order to provide its customers and employees a contextual and simpler digital user experience across the onboarding process. With the build of an end-to-end automated digital process, BMO has quickly realized substantial improvements in its efficiency ratios and account opening productivity.

The business case was built using paper as a currency and, after three months in production, the standardization of processes and the elimination of all paper forms; means the initiative is tracking to deliver savings of CAD$132 million ($98.2 million) annually.

BMO did not go it alone. They partnered with GMC Software and eSignLive by VASCO to design a universal enterprise platform that offers standardized eForms and eSignature and plug-and-play micro services capabilities.

The project kicked-off in December 2015 and the national rollout began in October 2016. By December 2016, BMO’s digital customer onboarding journey was in full production across its 940 retail branches in Canada.

"Among the many benefits of the project, the deployment of its platform across BMO's 940 Canadian retail branches is saving its 2,000-strong salesforce between 15 and 30 minutes a day on processing forms," commented Joan McGowan, Senior Analyst in Celent's Banking practice.

"Furthermore, BMO is well-positioned to migrate its other core business processes onto the platform and to continue its automation of its eForms and eSignature digital capabilities," she added.

Standardized End-to-End Process Delivers a Simplified Digital Employee and Customer Experience