2017/03/20

Abstract

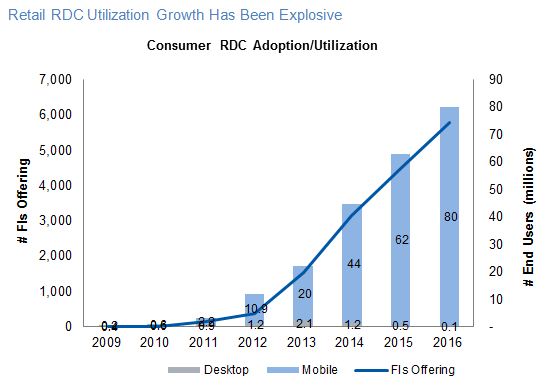

米国では過去2年間に2,600を超える金融機関がモバイルデポジットの運用を開始し、これを利用する個人顧客は8,000万人に上ると推定されます。

| KEY RESEARCH QUESTIONS | |

| 1 | RDCの現状と近い将来の見通しは? |

2 |

ベンダーは、どの分野の製品開発に投資しているか? |

| 3 | 主なトレンドと金融機関への影響は? |

金融機関による企業向けモバイルデポジットの導入は正しい選択ですが、多くの場合そのアプローチはその場しのぎであり、期待外れに終わりかねません。大部分の金融機関が提供している企業向けモバイルデポジットは「個人向け」ソリューションの預金上限額を引き上げただけのものになっています。多くのベンダーがより優れた機能を持つ適切な製品を投入しているにもかかわらず、銀行はそれらの採用には消極的です。

リモート・デポジット・キャプチャー(RDC)を利用すれば決済情報(送金票、インボイスなど)の抽出、認証および管理が可能ですが、それらの機能はいまだ正しく評価されていないままです。これらの機能を単独で、あるいは貸金庫サービスの一環として提供しているのはごく一部の銀行で、主に大手銀行に限られています。多方面でモバイルに関心が高まっているにもかかわらず、多くの銀行では、何の変哲もない従来のデスクトップ型の商用向けRDCの導入件数が2桁増のペースを維持しています。

「従来の法人向けデスクトップ型RDCは投入されてからかなりの年数が経っているとはいえ、今も驚くほど大きなビジネスチャンスが残っています。多くの銀行は、当面は年率約10%の増収を見込んでいます。」

「中小企業向けRDCの分野により魅力的なビジネスチャンスがあるにもかかわらず、銀行が商品戦略で行き詰らない限り、そうしたチャンスに気づくことはないでしょう」」と銀行プラクティスのシニア・アナリスト、ボブ・メーラは述べています。